Medicare Troubleshooter

TEL:+1 (424)-577-4658

TEL:+1 (866)-311-5030

Your Shield Against Insurance Rip-Offs for Seniors

Confused by Medicare? We're Your Trusted Guide, Every Step of the Way.

"Medicare shouldn’t come with surprise bills or complicated jargon. Get clear guidance from real people who care, no gimmicks, just support."

About Us

WELCOME TO MEDICARE

About /Why US

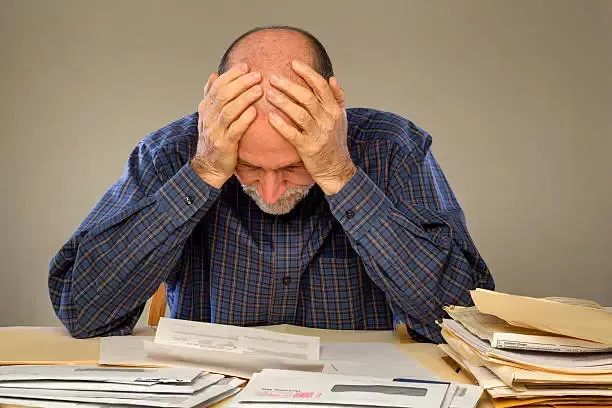

When my mom first had to pick a Medicare plan, I sat at the kitchen table with her, sifting through piles of mail and fine print. She was frustrated, confused, and honestly, a little scared of making the wrong choice. That’s when it really hit me—so many people are left on their own to figure this out, and it’s way too easy to end up in a plan that doesn’t fit.

I knew she wasn’t the only one. I’d heard the same stories you probably have—friends stuck with surprise bills or feeling trapped in a plan they thought would protect them. That’s why I teamed up with other advisors, and together—with over 100 years of combined experience—we started Medicare Troubleshooter.

Our promise is simple: we’re licensed, independent, and here for YOUR well-being, not your wallet.

OUR MISSION

Our mission is clear: to be your trusted advocate in the world of Medicare. We've seen the one-third of Medicare recipients who have chosen this path, and we're here to ensure that you have the guidance and support you need to make informed decisions.

"We’ve helped hundreds avoid expensive plan pitfalls. Here are the 10 most common, so you don’t have to learn the hard way."

The 10 Biggest Mistakes People Make When Picking a Medicare Plan & How To Avoid Them

Medicare can be confusing—so many choices, so much jargon. But it pays to do a little homework and pick the plan that’s right for you.

These would be things we can possibly fix with our team of experts.

Missing Medicare deadlines

It happens, multiple rules, multiple deadlines. But missing them can mean higher premiums or coverage gaps. We’ll remind you when it matters.

Blowing the special enrollment period

We understand how easy it is to miss deadlines or feel unsure about Medicare

rules—it happens to so many people. But that’s why the Special Enrollment Period (SEP) is so important. Using it wisely can bring peace of mind, knowing

you’re in a plan that fits your budget and your health needs. Without it, you might miss out on cost savings or stay in a plan that doesn’t really work for you.

Our goal is to make sure you never have to stress about those details alone—we’ll walk with you so you feel confident and protected every step of the way.

Delaying enrollment when your job insurance is second in line. ...

Delaying Medicare enrollment while relying on job-based insurance can lead to missed preventive care opportunities, risking your long-term health. Late enrollment penalties may result in higher Medicare premiums, impacting your finances. Job-based insurance might not cover all your healthcare needs, potentially leaving you with coverage gaps. Missing Medicare enrollment windows can delay access to essential benefits. Coordinating job-based insurance and Medicare can be complex, requiring careful planning to ensure seamless coverage transitions.

Not understanding Part B and Part D late enrollment penalties...

Not comprehending Medicare's Part B and Part D late enrollment penalties can lead to unexpected financial burdens, as these penalties result in higher monthly premiums. Moreover, these penalties are typically permanent, lasting as long as you have Medicare coverage, making it crucial to understand their long-term impact. The calculations for these penalties can be complex and vary from year to year, adding to the challenge. For Part D, penalties may result in gaps in prescription drug coverage, increasing out-of-pocket medication costs. Seeking professional guidance from Medicare experts can help beneficiaries navigate these complexities and avoid costly mistakes.

Not fully comparing original Medicare with Medicare Advantage plans.

Failing to thoroughly compare Original Medicare with Medicare Advantage plans can result in missed opportunities for comprehensive healthcare coverage. Incomplete comparisons may lead to misconceptions about out-of-pocket costs, network limitations, and prescription drug coverage, potentially impacting financial stability and access to preferred providers. Additionally, overlooking annual changes in Medicare Advantage plans can result in unexpected shifts in coverage. It's essential to conduct a comprehensive evaluation to make an informed choice that best aligns with your healthcare needs and financial situation.

Not Checking Hospital Networks A Crucial Consideration When Choosing a Medicare Plan

Checking hospital networks is crucial when choosing a Medicare plan. Your preferred hospital may not be in-network, leading to higher costs. Review the plan's provider directory and contact your hospital for confirmation. Emergency coverage is available at any hospital, but it's vital to understand the potential out-of-network expenses. Consider Medicare Supplement plans for more provider flexibility.

Not purchasing a separate hospital indemnity plan

Purchasing a separate hospital indemnity plan alongside your Medicare coverage is essential to fill coverage gaps, predict healthcare costs, and retain freedom of choice in providers. Assess your healthcare needs, compare plan options, and enroll during your Medigap Open Enrollment Period for the best rates and acceptance. Consulting a Medicare advisor can provide personalized guidance for selecting the right hospital indemnity plan, ensuring comprehensive coverage and financial peace of mind.

Going it alone

"Going it alone" with Medicare can be risky due to its complexity. Medicare involves various parts, enrollment periods, and coverage options, making expert guidance essential. Trying to navigate Medicare independently may result in missed benefits, financial consequences, and stress. Seek personalized advice from Medicare professionals to ensure informed decisions, maximize benefits, and enjoy peace of mind in your healthcare choices during retirement.

Not Reassessing Annually

Life changes—and so do Medicare plans. Your health needs, prescription drugs, and even provider networks can shift from year to year. That’s why it’s so important to take a fresh look at your Medicare coverage annually. The Annual Enrollment Period (AEP) gives you the chance to make sure your plan still fits your needs, your budget, and your peace of mind.

By reassessing each year, you can avoid surprises, stay protected, and make sure your coverage keeps working for you. And the best part—you don’t have to figure it out alone. We’re here to guide you through every step.

Failing to Seek Professional Help

Choosing a Medicare plan is one of those decisions that feels simple at first—until you realize just how many moving parts there are. Trying to figure it all out on your own can lead to costly mistakes or coverage that doesn’t really fit your needs.

That’s where professional guidance makes all the difference. Medicare experts can help you understand your options, avoid unnecessary costs, and choose a plan that truly supports your health and your budget. Most importantly, you’ll gain the peace of mind that comes from knowing you’ve made the right choice for your future.

Not signing up for Medicare at the right time. ...

it can result in late enrollment penalties, increasing your monthly premiums for Part B and Part D. It may lead to gaps in your healthcare coverage, leaving you vulnerable to high medical costs. Missing preventive care services can hinder early disease detection.

Blowing the special enrollment period. ...

Failing to utilize the Special Enrollment Period (SEP) can lead to financial strains, as missed opportunities for cost-effective plan changes occur. Delays in coverage adjustments are common, leaving individuals with inadequate insurance for an extended period. The inflexible timeframes of SEPs can result in being stuck with unsuitable plans. Evolving healthcare needs might go unaddressed, posing potential health risks. Additionally, neglecting SEP

Delaying enrollment when your job insurance is second in line. ...

Delaying Medicare enrollment while relying on job-based insurance can lead to missed preventive care opportunities, risking your long-term health. Late enrollment penalties may result in higher Medicare premiums, impacting your finances. Job-based insurance might not cover all your healthcare needs, potentially leaving you with coverage gaps. Missing Medicare enrollment windows can delay access to essential benefits. Coordinating job-based insurance and Medicare can be complex, requiring careful planning to ensure seamless coverage transitions.

Not understanding Part B and Part D late enrollment penalties...

Not comprehending Medicare's Part B and Part D late enrollment penalties can lead to unexpected financial burdens, as these penalties result in higher monthly premiums. Moreover, these penalties are typically permanent, lasting as long as you have Medicare coverage, making it crucial to understand their long-term impact. The calculations for these penalties can be complex and vary from year to year, adding to the challenge. For Part D, penalties may result in gaps in prescription drug coverage, increasing out-of-pocket medication costs. Seeking professional guidance from Medicare experts can help beneficiaries navigate these complexities and avoid costly mistakes.

Not fully comparing original Medicare with Medicare Advantage plans.

Failing to thoroughly compare Original Medicare with Medicare Advantage plans can result in missed opportunities for comprehensive healthcare coverage. Incomplete comparisons may lead to misconceptions about out-of-pocket costs, network limitations, and prescription drug coverage, potentially impacting financial stability and access to preferred providers. Additionally, overlooking annual changes in Medicare Advantage plans can result in unexpected shifts in coverage. It's essential to conduct a comprehensive evaluation to make an informed choice that best aligns with your healthcare needs and financial situation.

Not Checking Hospital Networks A Crucial Consideration When Choosing a Medicare Plan

Checking hospital networks is crucial when choosing a Medicare plan. Your preferred hospital may not be in-network, leading to higher costs. Review the plan's provider directory and contact your hospital for confirmation. Emergency coverage is available at any hospital, but it's vital to understand the potential out-of-network expenses. Consider Medicare Supplement plans for more provider flexibility.

Not purchasing a separate hospital indemnity plan

Purchasing a separate hospital indemnity plan alongside your Medicare coverage is essential to fill coverage gaps, predict healthcare costs, and retain freedom of choice in providers. Assess your healthcare needs, compare plan options, and enroll during your Medigap Open Enrollment Period for the best rates and acceptance. Consulting a Medicare advisor can provide personalized guidance for selecting the right hospital indemnity plan, ensuring comprehensive coverage and financial peace of mind.

Going it alone

"Going it alone" with Medicare can be risky due to its complexity. Medicare involves various parts, enrollment periods, and coverage options, making expert guidance essential. Trying to navigate Medicare independently may result in missed benefits, financial consequences, and stress. Seek personalized advice from Medicare professionals to ensure informed decisions, maximize benefits, and enjoy peace of mind in your healthcare choices during retirement.

Not Reassessing Annually

Reassessing your Medicare plan annually is vital. Health conditions change, plans evolve, and prescription drug coverage may shift. Cost considerations fluctuate, and provider networks can alter. The Annual Enrollment Period (AEP) is your chance to make informed changes and avoid penalties. Don't overlook this critical step in maintaining your healthcare coverage.

Failing to Seek Professional Help

Failing to seek professional help when choosing a Medicare plan is a common error that can have far-reaching consequences. Professionals possess deep knowledge of the complex Medicare system, tailor recommendations to your unique needs, and navigate enrollment periods and regulations. They ensure you make informed choices, potentially saving you money and providing peace of mind in your healthcare decisions. Avoid this mistake by consulting with experts who can guide you through the intricacies of Medicare.

What Our Clients Are Saying

Ms. Smith Los Angeles, CA

"Medicare felt like the enemy, but with the Medicare Troubleshooter team by my side, I had the allies I needed to win back peace of mind."

"Medicare felt overwhelming—rules, deadlines, and choices I didn’t understand. But the team at Medicare Troubleshooter stepped in and made the journey simple. They guided me through the maze, helped me choose the right plan, and gave me peace of mind knowing I’m protected."

Mr. Buchanan VA Beach, VA

Copyright 2025 - All rights reserved - Privacy Policy